The new GA Forms came into effect on June 15, 2022 for all grant applications in Alberta.

The Surrogate Rules of Court set out many of the rules that personal representatives must follow and the forms they must complete when applying to the Court of Queen’s Bench in Alberta for a grant of probate or a grant of administration of an estate. In an effort to modernize and simplify the process for getting a grant, Alberta amended these Surrogate Rules and simplified the forms. The new rules and forms came into effect on June 15, 2022. This article provides a brief overview of the important changes.

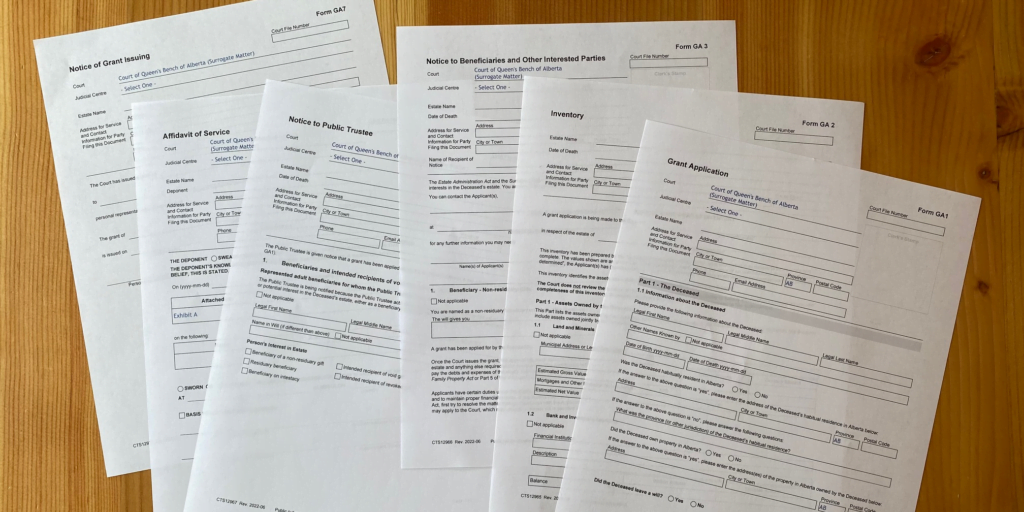

New Forms

The forms used before June 15th were called NC (Non-contentious) forms. These forms are replaced by new forms called GA (Grant Application) forms. You can find the GA forms on the Alberta Queen’s Printer website (for purchase) and the Government of Alberta website (for free). The GA forms are fillable PDF forms that you can download and save.

The Court accepted applications submitted prior to June 15, 2022 using the old NC forms. Effective June 15, 2022, the Court no longer accepts grant applications submitted using the NC forms. All applications must be submitted using the GA forms.

Most applicants will have to prepare and submit to the Court the following GA forms to get a grant:

- Form GA1 – Grant Application

- Form GA2 – Inventory

- Form GA3 – Notice to Beneficiaries and Other Interested Parties

- Form GA4 – Notice to Public Trustee (if there are minors or disabled adults interested in the estate)

- Form GA5 – Affidavit of Service

- Form GA7 – Notice of Grant Issuing

Below is a more detailed description of these forms.

Form GA1 – Grant Application

This form is a compilation of the information found in a number of NC forms. It has five parts:

Part 1 – The Deceased

The applicant must provide the full legal name (and other names known by), date of birth and date of death, and last address of the deceased.

The applicant must also indicate the net value of the deceased’s estate in Alberta. This information is gathered in more detail in Form GA2 Inventory. The Court uses the net value of the estate to calculate the court fees charged for processing and issuing the grant.

Part 2 – The Applicant(s)

The information collected here is about the applicants and their right and priority to apply for the grant. The applicant may have authority as stated in the will, or, if there is no will, as set out in the Estate Administration Act. The applicant must include here any renunciations, nominations, bonds (for applicants residing outside of Alberta), and consents of beneficiaries to proceeding without a bond.

In this part, the applicant sets out information about the will and any codicils. They must also attach any other documents referred to in the will (such as a matrimonial property settlement agreement, or a list directing the distribution of personal items).

Part 3 – Persons requiring notification

This part lists the names, mailing addresses and email addresses of the beneficiaries of the estate, along with a description of the gift each beneficiary is to receive. It also lists any persons with potential claims against the estate, such as a spouse or adult interdependent partner who is not receiving all of the deceased’s estate, children under the age of 18, adult children unable to earn a livelihood due to disability, or missing persons.

Part 4 – Documents and Other Information for the Court’s Consideration

The form requires the applicant to include the will/codicil, affidavit of witness to a will/codicil, and any relevant court orders, renunciations, nominations, bonds, etc.

There is also a new requirement that the applicant provide the Court with proof of death. Acceptable documents proving death are a Death Certificate or Funeral Director’s Statement of Death.

Part 5 – Applicant’s Oath or Affirmation

The Estate Administration Act and the Surrogate Rules set out the roles and responsibilities of an applicant (personal representative of an estate). But many applicants are not aware of these. Now, the Form GA1 sets out many of these roles, responsibilities, and duties of the personal representative, and the applicant must acknowledge and undertake to perform them.

Notably, the applicant must swear or affirm that all the information in the grant application is true to applicant’s best knowledge and belief, including:

- believing the deceased made the original will/codicil submitted

- not knowing of any later wills or codicils

- acknowledging they have reviewed the Schedule of core tasks of a personal representative listed in the Estate Administration Act

- acknowledging they must carry out the core tasks of a personal representative, which are:

- identifying the estate assets and liabilities

- administering and managing the estate

- satisfying the debts and obligations of the estate

- distributing and accounting for the administration of the estate

The applicant must also acknowledge the law requires them to perform the role of personal representative:

- honestly and in good faith

- in agreement with the deceased’s intentions as set out in the will/codicil (if there is one)

- with the care, diligence, and skill that a person of ordinary prudence would exercise in comparable circumstances where a fiduciary relationship exists

The applicant must undertake to:

- give proper notice of the application to those entitled to receive notice and serve the Form GA2 Inventory on those entitled to receive it

- file proof of service in Form GA5

- if the value of any asset or debt is “to be determined”, serve an amended Form GA2 Inventory on those persons entitled to receive one when updated information is available

Finally, the applicant must:

- acknowledge they must distribute the estate as soon as practicable

- acknowledge they will get a signed Form GA20 from any trustee before distributing property to that trustee

- undertake to notify all beneficiaries and persons with potential claims against the estate who were identified in the application by providing them with notice when the Court issues the grant

- agree to faithfully administer the deceased’s estate according to law and give a true accounting of their administration to the persons entitled to it when lawfully required

Form GA2 – Inventory

There are two important changes to the reporting requirements for the deceased’s assets and debts. Before June 15, 2022, the applicant only had to report assets the deceased owned that were located within Alberta. In Form GA2, the applicant must now list:

- the deceased’s assets located within Alberta as well as those assets located outside Alberta, and

- any assets the deceased owned jointly with other persons who are not the deceased’s spouse or adult interdependent partner.

The Inventory form has four parts.

Part 1 – Assets owned by deceased

This is a list of assets located within or outside Alberta, such as land, bank accounts, investment accounts, shares in companies, annuities, life insurance, household goods, and personal effects.

Part 2 – Assets owned jointly by the deceased and persons other than a spouse or adult interdependent partner

The ownership and transfer of a deceased’s jointly-owned assets are governed by rules that have evolved over time through the courts (common law). Depending on the circumstances, jointly owned assets may form part of the deceased’s estate or may pass outside of the deceased’s estate by right of survivorship to the surviving joint owner.

The applicant must list the jointly owned assets to the best of their ability using the information available to them. The list of jointly owned assets may not be complete because the applicant may not be legally entitled to all the required information about the asset.

Part 3 – Liabilities

The applicant must list all debts and expenses of the deceased as of the date of death.

Part 4 – Net value of estate

Tally the assets within and outside Alberta separately. The net value of the estate within Alberta is calculated by adding the deceased’s total assets within Alberta and the jointly owned assets that form part of the deceased’s estate within Alberta, and then subtracting the deceased’s total liabilities.

Another important change is that Form GA2 Inventory is no longer part of the primary application (Form GA1). This means the Court clerks do not review the Inventory. The applicant must serve Form GA2 Inventory on the residuary beneficiaries (as part of Form GA3 Notice) and must file it with the Court when they file Form GA5 Affidavit of Service.

Form GA3 – Notice to Beneficiaries and Other Interested Parties

The old NC forms had different notices for different beneficiaries. There is now one consolidated notice form for all beneficiaries and other interested parties. The following people must receive this form:

- a non-residuary beneficiary (a person receiving a specific gift)

- a residuary beneficiary (a person receiving part of the residue of the estate)

- a beneficiary on intestacy where there is no will

- a beneficiary of a void or revoked gift

- a family member with a potential claim against the estate (for example, a spouse, adult interdependent adult, former spouse, former adult interdependent adult, minor child, adult child who is unable to earn a livelihood due to a disability)

Form GA4 – Notice to Public Trustee (if there are minors or disabled adults interested in the estate)

The applicant must provide notice of the application to the Public Trustee in certain circumstances. These include when there is a minor child interested in the estate, a missing beneficiary, or the Public Trustee is the trustee for a beneficiary of the estate.

Form GA5 – Affidavit of Service

One of the important oversight roles of the Court is to ensure all persons entitled to receive notice of the application have been served with notice. The Court achieves this by requiring the applicant to serve Form GA3 on those entitled to receive notice of the application and then submit to the Court a sworn Form GA5 Affidavit of Service confirming they served the notices.

The order of service and filing has changed to bring the surrogate process in line with all other court filing processes. Under the new Surrogate Rules, the applicant must first file Form GA1 Application with the Court and then serve a Form GA3 Notice on all interested parties. The Court will not issue a grant until it has received a filed Form GA5 Affidavit of Service for each interested party.

Form GA7 – Notice of Grant Issuing

This is a new form and requirement. Upon receiving the grant, the applicant must serve interested parties with a notice saying the Court has issued the grant. Interested parties include any persons with potential claims against the estate such as a spouse or adult interdependent partner who is not receiving all of the deceased’s estate, children under the age of 18, or adult children unable to earn a livelihood due to disability.

Towards a More Efficient Process

One of the goals of the surrogate reform project was to simplify the forms and reduce the duplication of information required under the NC forms. The new GA forms are intended to create a more streamlined and efficient process for processing grant applications in Alberta.

EDITOR’S NOTE Read CPLEA’s Getting a Grant of Probate and Administration in Alberta booklet to learn more about the process for getting a grant.

Looking for more information?

Disclaimer

The information in this article was correct at time of publishing. The law may have changed since then. The views expressed in this article are those of the author and do not necessarily reflect the views of LawNow or the Centre for Public Legal Education Alberta.

Looking for articles like this one to be delivered right to your inbox?