The Federal Child Support Guidelines provide a framework for the payment of child support that a parent pays to support a child financially after a separation or divorce.

The Federal Child Support Guidelines provide a framework for the payment of child support that a parent pays to support a child financially after a separation or divorce.

What are the Federal Child Support Guidelines?

As stated in Paragraph 1 of the Guidelines, their purpose is:

(a) To establish a fair standard of support for children that ensures that they continue to benefit from the financial means of both spouses after separation;

(b) To reduce conflict and tension between spouses by making the calculation of child support orders more objective; The Federal Child Support Guidelines apply to children of the marriage who are under the age of majority or who are “the age of majority or over but [are] unable, by reason of illness, disability or other cause to obtain the necessities of life.”

(c) To improve the efficiency of the legal process by giving courts and spouses guidance and encouraging settlement; and,

(d) To ensure consistent treatment of spouses and children who are in similar circumstances.

The Federal Child Support Guidelines apply to children of the marriage who are under the age of majority or who are “the age of majority or over but [are] unable, by reason of illness, disability or other cause to obtain the necessities of life.” The Government of Canada guide suggests that “Generally, the courts recognize the pursuit of post-secondary education as a valid ‘other cause’.”

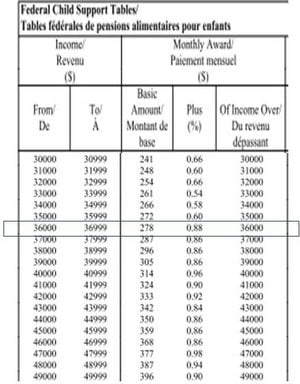

The tables included with the Federal Child Support Guidelines are laid out, by province/territory, in the following format (the following example is for Alberta and one child and for illustrative purposes and brevity the following excerpt shows annual Income (as defined within the Guidelines) from $30,000 to $49,999):

The Federal Child Support Guidelines include tables, by province / territory, for one, two, three, four, five, or six or more children and the tables are in $1,000 ranges from $0 to $150,000 of annual income.

As an example, using the excerpt of the Alberta table disclosed above, the Monthly Award in Alberta where there is one child and the spouse’s income is $36,500 is calculated as follows:

$278 + 0.88% * ($36,500-$36,000) = $282 per month ($3,384 per year)

Or, you can do the calculation one step at a time:

- Income over 36000: $36,500-$36,000 = $500

- Amount to add: $500 x 0.88% = $4

- Payments = $278 + $4 = $282 per month

- $282 x 12 = $3,384 per year

How is Income Calculated?

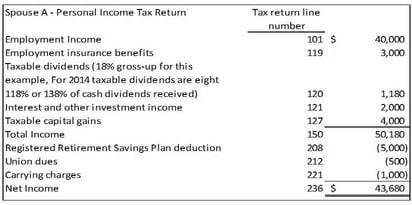

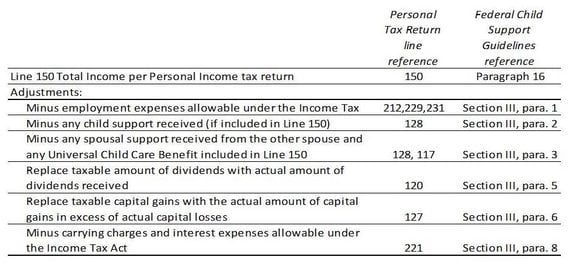

Income is defined by the Federal Child Support Guidelines as Total Income (line 150) as disclosed on a spouse’s personal income tax return, which includes all employment income, taxable capital gains, taxable dividends, etc. The Federal Child Support Guidelines stipulate adjustments to Total Income, the most common of which are summarized as follows:

Income is defined by the Federal Child Support Guidelines as Total Income (line 150) as disclosed on a spouse’s personal income tax return, which includes all employment income, taxable capital gains, taxable dividends, etc.

Income is defined by the Federal Child Support Guidelines as Total Income (line 150) as disclosed on a spouse’s personal income tax return, which includes all employment income, taxable capital gains, taxable dividends, etc.

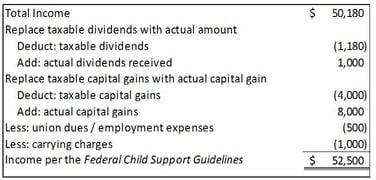

In general terms, the above noted adjustments revise a spouse’s Total Income as reported on their personal Income Tax Return to a cash balance, less child and spousal support received, if any. The application of the above is illustrated by way of the following example.

Example:

Spouse A and Spouse B are both resident in Alberta and have two children from their marriage under 18 years of age. Spouse A and Spouse B are divorced, the children are resident with Spouse B, and Spouse B is to receive child support from Spouse A in accordance with the Federal Child Support Guidelines. Spouse A’s personal income tax return discloses the following:

Given the above scenario, the calculation of Income under the Federal Child Support Guidelines would be as follows:

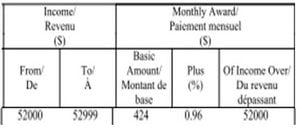

The rates per the Federal Child Support Guidelines for Alberta for two children and income between $52,000 and $52,999 A spouse can request (up to once a year) the other spouse’s tax returns and other information relevant to the calculation of income under the Federal Child Support Guidelines. and the resulting calculation of the monthly child support payment are shown below:

$424 + 0.96% * ($52,500 – $52,000) = $429 per month ($5,148 per year)

Or you can do the calculation one step at a time:

- Income per Guidelines that is over $52,000: $52,500 – $52000 = $500

- Amount to add: $500 x 0.96% = $5

- Payments: $424 + $5 = $429 per month

- $429 x 12 = $5,148 per year

Further, the Federal Child Support Guidelines (section 14) indicate that a change of circumstances (i.e. a change in the annual income of a spouse) can result in a change in the amount of a child support order. A spouse can request (up to once a year) the other spouse’s tax returns and other information relevant to the calculation of income under the Federal Child Support Guidelines. In this way, the Guidelines provide a mechanism for a spouse to be able to monitor income of the other spouse to ensure that the calculation of child support remains relevant and reflective of current income levels.

Under a split custody scenario, the Federal Child Support Guidelines (section 8) state that “where each spouse has custody of one or more children, the amount of a child support order is the difference between the amount that each spouse would otherwise pay if a child support order were sought against each of the spouses.” That is, if the calculation of income of one spouse in the split custody scenario results in a monthly child support amount of $800 per month per the tables and the calculated child support amount of the other spouse is $500, the difference of $300 per month (payable by the higher earning spouse) would be the child support order under section 8 of the Federal Child Support Guidelines.

Conclusion

This article provides a basic outline of the Federal Child Support Guidelines. Some situations can be relatively straightforward but others can be a great deal more complicated. It is important to note that the Federal Child Support Guidelines include various means to allow a court to vary the calculated child support amount for the particular situation, or the court may consider a written agreement between spouses as to a spouse’s income for the purposes of the Federal Child Support Guidelines. More complicated situations may include: self-employment; special or extraordinary expenses; undue hardship; and consideration of the standard of living of the spouse.

Further, where related companies are involved (i.e. a spouse receives employment income from a company that the spouse owns), the matter becomes significantly more complicated due to the inherent complexity of the discretionary, non-arm’s length nature of the spouse’s relationship with his/her company. The impact of these scenarios can be complicated and it is best to seek the appropriate advice.